Understanding the Landscape of Social Media Influence

Deciphering the Social Media Maze for Startups

In today's digital era, the landscape of social media influence has become a pivotal aspect of how startups navigate the complexities of accounting and financial management. Influencers play a critical role in shaping the financial strategies of burgeoning businesses. Understanding this evolving landscape is essential for companies aiming to harness the power of social media to bolster their growth and compliance with international tax regulations. The intersection of social media and startup accounting is a fascinating domain. Influencers, with their vast reach and engagement, assist startups in promoting their services, boosting brand awareness, and even guiding financial decisions. This influence extends beyond mere promotion; it intricately ties into the planning and execution of global tax compliance strategies. Startups, particularly early-stage and tech-driven ones, can leverage these networks to enhance their understanding and implementation of international tax and transaction services. Today, a robust social media strategy transcends conventional marketing. It acts as a support system, helping startups connect with global accounting firms and CPAs who offer expertise in tax planning, accrual accounting, and compliance consulting. These partnerships help companies manage cash flow, utilize tax credits, and optimize financial reporting. However, integrating social media influence into accounting practices is not without its challenges. Startups must navigate the complexities of ensuring accurate and compliant financial statements, maintaining cash flow, and managing accounts payable effectively. Influencers and content creators aid in spotlighting accounting softwares and services that cater specifically to the needs of these budding enterprises. The evolving dynamics of social media demand that startups remain agile and informed, always ready to harness the next big trend in digital influence to optimize their tax services and overall business management. In the following sections, we'll explore how some firms have successfully integrated social media practices into their accounting services and the emerging trends shaping this symbiotic relationship.The Role of Influencers in Shaping Financial Strategies

Influencers' Impact on Financial and Tax Strategy

The role of influencers in the business ecosystem is not limited to brand promotion; their reach now extends into strategic aspects of financial and tax planning. For startups navigating the intricate landscape of international tax and accounting, seasoned influencers can offer invaluable guidance derived from their vast experience and network.

Startups often face unique financial challenges such as managing accounts payable, understanding accrual accounting principles, and strategizing for cash flow optimization. Influencers in the financial and accounting realms can help demystify these areas, drawing on a wealth of practical know-how. These individuals often share insights on effective tax planning and compliance, offering businesses a chance to gain a competitive edge through enhanced financial services planning.

For tech startups and firms aiming to expand internationally, influencers play a critical role in facilitating better comprehension of international tax obligations and compliance issues across various jurisdictions. They provide startups with the necessary information to leverage tax credits effectively, helping them to maximize financial reporting accuracy and strategic cash management.

Accountants and accounting firms that collaborate with social media influencers can enhance their visibility and reach to new clients seeking expert consultancy, CPA services, and other critical accounting services. This collaboration is particularly beneficial for early-stage companies that require guidance in establishing robust financial management practices to appeal to potential investors, including venture capitalists.

Additionally, influencers in the financial sector often share insights based on real-world business scenarios, offering startups actionable advice on leveraging accounting software for better financial governance. They bring to light the nuances of preparing comprehensive financial statements that are compliant with international standards, thus fostering improved tax and financial planning.

Challenges Faced by Startups in Global Tax Compliance

Global Tax Compliance Obstacles

Navigating the intricacies of international tax compliance presents a unique set of challenges, particularly for startups. These emerging businesses often lack the resources or internal expertise to handle the complex landscape of global tax regulations effectively. Compliance demands a robust understanding of international tax codes and an agile approach to account for the diverse financial landscapes these companies operate in. Startups typically face issues such as varying tax rates, currency fluctuations, and differing financial reporting standards, requiring consistent vigilance and strategic tax planning. Accounting firms and consulting services can offer invaluable support by helping startups understand and meet these rigorous requirements. Moreover, early-stage businesses might find navigating accounts payable systems and managing cash flow difficult, as these elements require precision and detailed knowledge of local laws. For companies expanding across borders, leveraging accounting software and international tax consulting services becomes imperative. This minimizes errors and ensures accuracy in financial statements necessary for securing venture capital, an essential funding source for many tech startups. The complexity of today's tax compliance environment is exacerbated by the need to juggle accrual accounting methods with cash accounting processes. To manage these intricacies, many startups rely on specialized accounting services, like CPA firms, to ensure they stay abreast of tax credits and policies. Keeping a team of knowledgeable accountants helps maintain compliance with international norms and boost financial management, providing a stable footing amidst the turbulent waters of globalization.Leveraging Social Media for Effective Transaction Services

Integrating Social Media for Transaction Efficiency

Navigating the complexities of startup accounting in today’s digital age can be daunting. Among the myriad possibilities, social media stands out as a pivotal tool, leveraging its powerful influence to drive effective transaction services. For startups, capitalizing on social media can streamline transactional workflows and foster improved operational efficiency. Incorporating social media strategies into traditional accounting services opens new avenues for early stage tech startups. By engaging with international audiences, businesses can tap into broader markets for potential investors and partners. This not only enhances brand visibility but also aids in the identification of unique tax credit opportunities suitable for global business operations. Moreover, finance professionals, including CPAs and accounting firms, are increasingly consulting their clients on ways to weave social media insights into comprehensive financial planning. These insights can optimize cash flow analysis and facilitate accurate accounts payable procedures through real-time data collections. CPA firms and financial experts understand that social media analytics can offer valuable benchmarks against which companies can measure financial statements and overall business health. When startups deploy social media effectively, they gain access to a plethora of resources, ranging from tax planning frameworks to accrual accounting advice. International tax compliance becomes more navigable as real-time social interactions highlight pressing industry trends. With this advantage, startups can proactively address potential tax liabilities before they impact the financial bottom line. To foster successful integration of social media in accounting practices, startups should build competent teams skilled in both digital media and financial services. These teams can utilize cutting-edge accounting software solutions designed to harness the power of social media, ensuring that transactional processes align with global standards. Ultimately, social media influence does not merely reckon as a tool for marketing, but a vital component of the financial machinery that services startups. By embracing this evolution, accounting firms and tech startups alike can remain competitive and agile in an ever-changing financial landscape.Case Studies: Successful Integration of Social Media in Accounting Practices

Real-Life Examples of Social Media Integration

In recent years, several startups have successfully tapped into social media influence to enhance their accounting practices and overcome international tax and transaction challenges. These companies have harnessed the power of influencers and online platforms to streamline their financial strategies, demonstrating the potential for others seeking innovative solutions.

Startup Accounting in Action

One exemplary business that leveraged social media is a tech startup in the early stage of its development. By collaborating with financial influencers, the company enhanced its tax planning strategies. These influencers helped demystify complex topics like international tax and compliance, making the information more accessible to the startup's management team.

In addition, by engaging with audiences on social media, the startup received feedback on its accounting software and financial reporting tools. This interaction prompted improvements in their services, ultimately aiding in better cash flow management and planning.

Utilizing Online Networks for Improved Financial Services

Another example involves a startup accounting firm that specializes in international tax services. This firm successfully used social media platforms to establish themselves as thought leaders in tax compliance. By regularly sharing insights and updates on tax credits, accrual accounting, and financial statements, the firm attracted a significant following of potential clients.

Their online presence helped in consulting with startups and early-stage companies seeking efficient accounting and tax services. It also enabled them to perform effective outreach to those looking for professional CPA support, further solidifying their authority in the accounting firms sector.

Transformative Influence in Financial Consulting

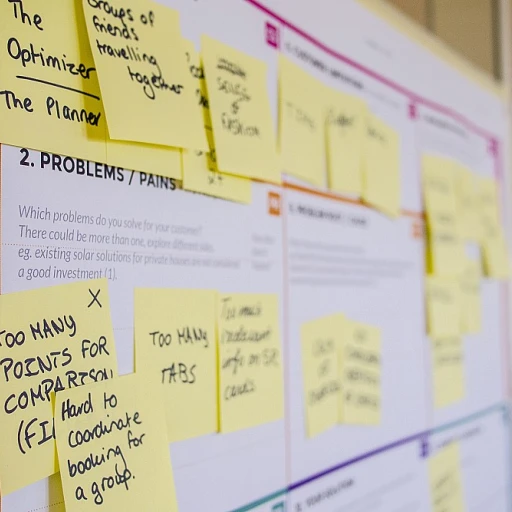

Finally, a case study of a venture capital-backed startup reveals the substantial impact of social media on business planning and financial reporting. The startup used influencer partnerships to identify crucial pain points in accounts payable and financial management processes. This insight was pivotal in refining their transaction services offering, making it more appealing to both domestic and international companies.

Successful strategies from these case studies underscore the transformative potential of social media in revolutionizing startup accounting practices. They showcase how online networks can be leveraged for meaningful engagement, driving strategic innovation and financial success.