Understanding the Basics of Safe Conversion

Introductory Concepts of Safe Conversion

In the realm of startup financing, understanding safe conversion forms a crucial part of the journey for both founders and investors. Before diving into the reasons one might decide to convert safes, it is important to grasp the fundamentals of what this process entails. A safe, which stands for Simple Agreement for Future Equity, is an agreement between a company and an investor. It is not a debt instrument, but rather a method to gain future equity in the company without setting a specific valuation at the time of initial investment. The conversion occurs during a future priced equity round, wherein the initial investment converts into shares of the company. This is usually triggered by specific events like a new equity financing. Convertible notes or safe notes provide a flexible route for early-stage startups to secure funding without having to determine their precise pre-money or post-money valuation. Investors can benefit from a valuation cap and a cap discount, which specify the maximum valuation for price share conversion and a discount rate to incentivize early funding. This system not only simplifies the raising of money for startups but also aligns the interests of founders and investors by preparing for future equity rounds. It negates the need for a comprehensive company valuation at an early money valuation stage, when the true worth of the concept is still being proven. This dynamic plays a key role in driving the growth and sustainability of startups and is essential for the investors who aim to maximize their return on investment during subsequent financing rounds. By gaining insights into the intricacies of safe conversion, investors and founders can better navigate the challenges and seize the opportunities presented during the financing journey. For aspiring corporate executives, the right education can augment one's ability to leverage these financial instruments effectively, equipping you with the knowledge to excel in corporate finance and investment strategies.Reasons for Converting Safes

Exploring the Motives Behind Safe Conversion

Converting safes in the world of finance is becoming an increasingly attractive option for investors, founders, and early-stage startups. Understanding this trend requires diving into the reasons and motivations that drive these conversions. Let's explore some key factors that are influencing this shift. One major driver is the flexibility that safe notes offer compared to traditional equity financing. Unlike priced equity rounds, safes allow startups to raise money swiftly without having to determine a precise company valuation upfront. This aspect is particularly appealing in environments where startups need to act quickly to capitalize on market opportunities. The use of a pre-money or post-money valuation cap enables early-stage companies to establish a ceiling on the company's valuation for future equity conversions, offering a protective mechanism for both investors and founders. Additionally, there is the investor perspective to consider. Safe notes typically include a discount rate, or cap discount, which entices investors to lend money to companies with the promise of convertible notes. These convertible notes are designed to convert into shares at favorable terms during a future financing round. Not only does this offer investors a potentially higher return on their pro rata shares, but it also gives them a foothold in promising startups before their equity significantly appreciates in value. Furthermore, the seamless nature of safe conversions aligns with modern financing strategies for startups seeking to scale. These companies often face the challenge of preserving funds while maximizing their equity valuation. By employing safes, startups can sidestep the lengthy and costly processes associated with conventional financing rounds, thus preserving their equity for future growth. In conclusion, safes have emerged as a powerful tool for balancing the interests of both startups and investors. They provide the flexibility, speed, and potential for financial gain that are essential in today's fast-paced investment climate. For those looking to deepen their understanding of the strategic implications of safes, exploring the best certifications for aspiring CEOs can offer valuable insights into leveraging these innovations effectively.Materials and Tools Required

Essential Materials for Safe Conversion

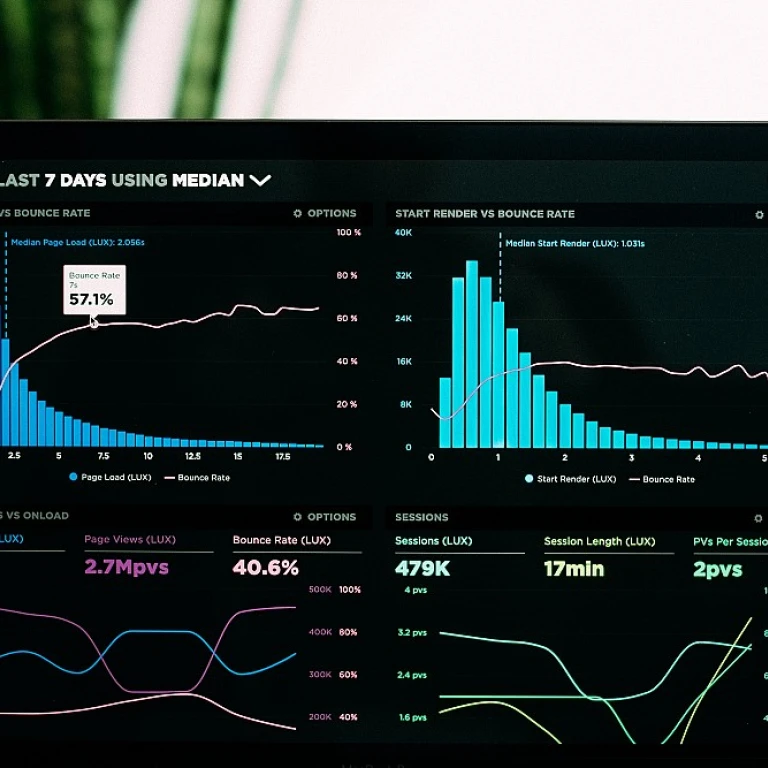

Understanding the required components for safe conversion is crucial in optimizing the process and ensuring efficiency. For those delving into the nuanced world of converting safes to more flexible financial instruments, having a well-prepared toolkit can make all the difference.- Convertible Notes: These are debt instruments that are converted into equity, typically during a subsequent financing round. Before any conversion, you need to be clear on whether convertible notes or safe notes suit your business strategy best.

- Valuation Cap and Discount Rate: The valuation cap sets the maximum price at which investment will convert into equity, while the discount rate offers early stage investors a lower conversion price than subsequent investors. These elements require detailed documentation to align investor expectations.

- Cap Table Management Tools: Facilitating equity management and ensuring accurate record-keeping aids in providing transparency to stakeholders. Reliable tools can help maintain the cap table clean, displaying clearly when conversions occur and their effect on valuation.

- Equity Round Agreements: Drafting comprehensive agreements ensures that all aspects of the convertible notes and safe notes conversion are documented. Proper agreements prevent disputes and solidify the understanding between founders and investors.

Step-by-Step Conversion Process

Initiating the Conversion Process

Embarking on the conversion of a safe involves a series of meticulous steps. Understanding the fundamental reasons and the necessary materials is crucial before diving into the actual process. Here, we break down the conversion into manageable stages to ensure clarity and precision.

Preparing for Conversion

Before any physical work begins, it's essential to gather all required materials and tools. These include the safe itself, any necessary equity notes, and tools for valuation and adjustment. Ensuring everything is at hand will streamline the process and prevent unnecessary delays.

Executing the Conversion

- Assessment: Begin by assessing the current state of the safe. This includes evaluating its pre-money and post-money valuation, which will guide the conversion process.

- Documentation: Gather all relevant documents, such as convertible notes, safe notes, and any equity financing agreements. These documents will form the backbone of the conversion.

- Valuation Adjustment: Adjust the valuation cap and discount rate as necessary to align with the current market conditions and the company’s growth trajectory.

- Equity Allocation: Determine the number of shares to be converted. This involves calculating the price per share and ensuring that the conversion aligns with the agreed-upon financing round terms.

- Finalization: Once all calculations are verified, finalize the conversion by updating the safe’s status to reflect the new equity position.

Post-Conversion Review

After completing the conversion, it's imperative to conduct a thorough review. This includes ensuring compliance with all regulatory requirements and verifying the security of the newly converted equity. Engaging with investors and founders to confirm the conversion details can prevent future disputes and foster a transparent relationship.